Welcome to FJB Accounting Limited

Accounting for you

Our mission is to provide a professional and supportive service which exceeds expectations. Meeting your needs is our highest priority.

Our clients include individuals, limited liability companies, self employed traders, property owners and investors.

We believe in good communication, keeping you fully aware of accountancy and tax matters relevant to your business. Knowing your financial position in real time helps you to make informed decisions.

We offer support in meeting deadlines to file your statutory accounts and tax returns with HMRC and Companies House.

Helping you develop and grow your business is important to us. We provide professional and customer-focused solutions to free up your time, allowing you to focus on running your business.

In essence, we feel passionately that your success is our success.

Meeting your needs is our highest priority

Personal Service

Taking pride in providing a high value service.

Our Services

We provide the following services for limited liability companies, the self employed and individuals needing to submit a tax return:

- Company tax returns

- Self Assessment tax returns

- Bookkeeping

- Business start-up

- Incorporation services – becoming a limited company

- Preparation for final accounts

- Business advisory to support your business

- VAT returns

- Payroll

- Administering pensions – auto enrolment

- Invoicing

Our Location

We work with clients based all over the UK. Virtual meetings and cloud based accounting software make it possible to offer a personal service to all our clients.

Contact Us

We are available to discuss your needs by telephone or via email

Call

0797 270 3397

Adding Value

We aim to add value to you as our client by:

Keeping accurate accounts and bookkeeping records

Keeping accurate business records throughout the year gives you the reassurance that your income, expenses, profit and tax liabilities are accurate and in real-time. You can make informed management decisions based on your financial position and you will avoid the surprise tax bill at the end of the year.

Preparing tax assessments and submissions for HMRC and Companies House

We will manage and submit your HMRC tax assessments.

Paying more tax than is necessary is something that no-one wants to do. We offer tax planning so you can maximise your allowances, all within HMRC rules.

Complying with legislation for payroll and pensions

We manage your payroll and ensure that you are up to date with the regularly changing legislation. Pension Auto Enrolment is a legal responsibility for all employers and we can help set this up and meet your legal obligations with The Pension Regulator.

Helping prepare for Making Tax Digital

Making Tax Digital (MTD) is HMRC’s initiative to keep and report digital accounts. The plan signals the end of paper accounting for millions across Britain. We have invested in the software to help you move your accounts to the digital platform.

Advising and submitting Self Assessment Tax Returns

We can help if you are self-employed, own property, have income from abroad, make personal pension contributions other than through your employer, sell assets and receive share dividends.

Giving you the added bonus of sustainability

Making Tax Digital (MTD) is an ideal opportunity to move away from paper-based records. We help you make ‘paperwork’ a thing of the past. Digital uploading and storage of accounting records not only complies with HMRC’s new initiative but also helps to protect our planet.

Alison SArmiento

DirecTor of Eximious alliance Limited

“Fiona has been our accountant from day 1 and we love working with her. She is incredibly knowledgeable and could not have been more supportive in terms of setting up our business and providing ongoing advice and support to enable us to make the financial decisions needed to grow the business. We know we are in safe hands with Fiona and look forward to continuing to work with her as our business grows.”

Testimonials

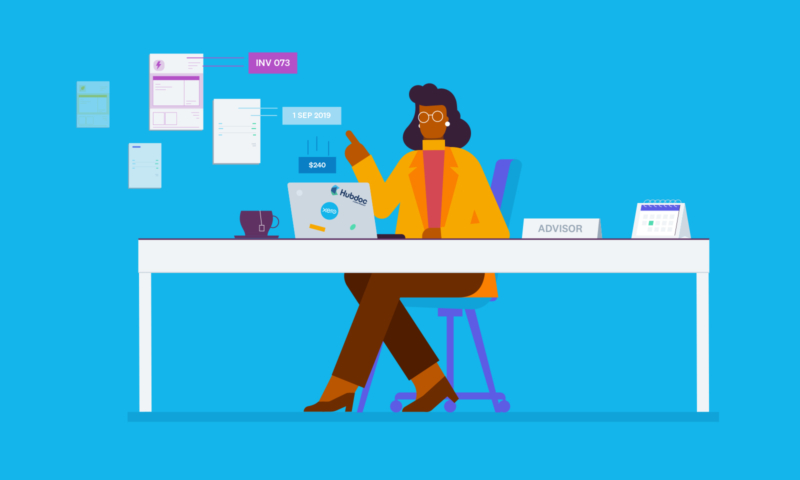

XERO PARTNER

We use Xero and Hubdoc

Specialising allows us to help you get the most from your software.

We can help onboard you to Xero and offer advice on invoicing templates, raising bills, adding contacts and setting up repeating invoicing. Xero can become the hub of your business and with an array of associated apps, you can run your business from a desktop PC, tablet or through your mobile phone whilst you are on the go.

“Let us help free up your time so you can concentrate on running your business and enjoy your life away from work.”

Fiona Beech

Managing Director, FJB Accounting Ltd